Make faster, smarter brand decisions.

Access better brand data, faster insights, and industry expertise for less.

Set your brand apart

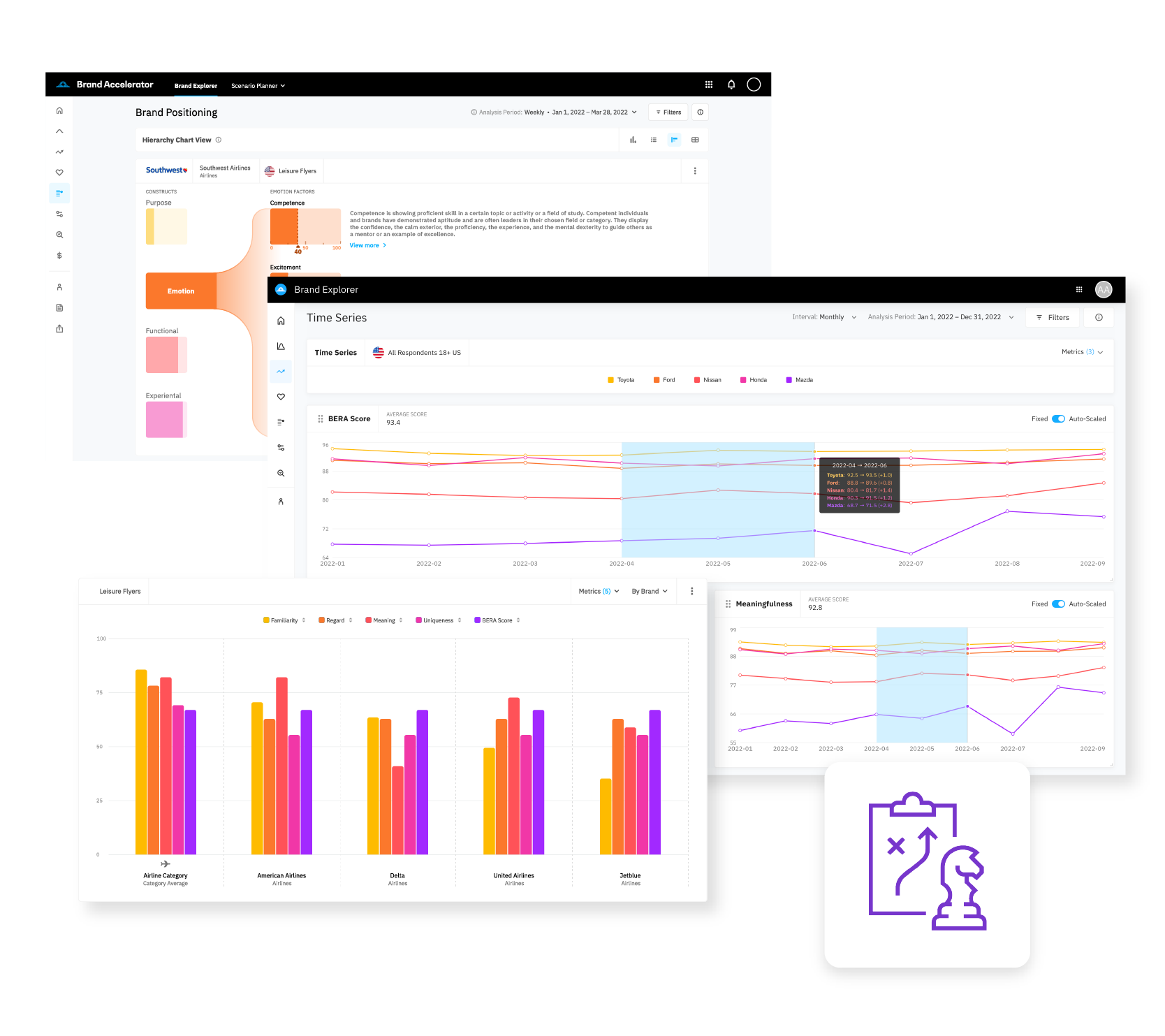

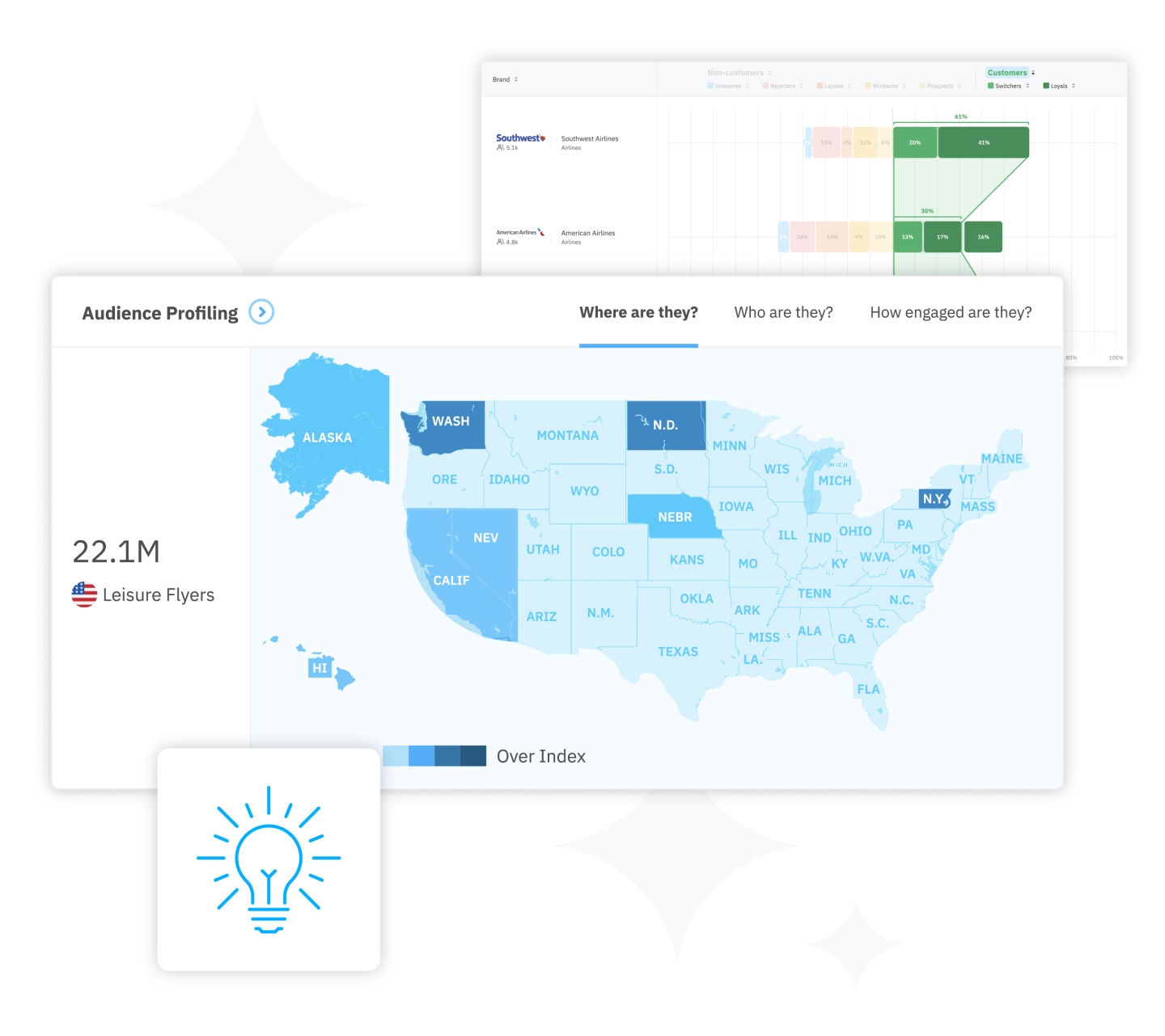

Use exclusive, big brand data to find the precise positioning and perfect message to put your brand in front of the right audience.

Measure and optimize brand health in real-time with prescriptive recommendations drawn from the streaming AI-driven brand intelligence software.

Understand brand performance changes over time, build data-driven predictive scenarios, and unlock which opportunities will drive the most significant impact to increase your brand equity and financial results.

Turn your brand into a value-driving asset by measuring the causal connection between brand investments and the impact those have on short- and long-term business results.

Use a ready-made solution to address your branding concerns, from brand positioning to audience prioritization. Unify all your branding efforts by connecting BERA brand metrics and data across any brand initiative.

Go beyond brand tracking and build equity.

Move past outdated brand tracking practices and static research reports to see how real-time data and access to the world’s largest data stream unlocks brand growth and financial impact.

Gain a 360' view of how your brand and others are performing.

Always know how your brand and others are performing in market, assess risks, discover new opportunities to connect with consumers, and grow engagement and brand loyalty.

Measure current and future brand performance in real-time.

Drive faster growth and customer loyalty with high-frequency brand tracking, predictive forecasting, scenario planning, and real-time insights on 130+ metrics across 4,000+ global brands.

Access more historical data and richer sample for greater analysis.

Tap into many years of historical tracking data on the world's largest brands and gain access to 1M+ census matched data captured globally for greater sample and resolution.

Trusted by the brands you know and love

See why today’s most influential brands rely on BERA, the world’s only Predictive Brand Technology™, to continuously measure brand equity, maximize financial impact, and manage their brand purpose with agility and confidence.

Access the right insights faster with AI-driven brand intelligence.

Benefit from 24/7 brand intelligence that delivers rich consumer and competitive insights in real-time by automating the collection, analysis, measurement, and decision making to optimize your brand strategy and drive growth in months, not years.

Access the right insights faster with AI-driven brand intelligence.

Make the right decisions with Predictive Brand Technology™.

Make the right decisions with Predictive Brand Technology™.

Go beyond static reports and historical brand tracking with technology that monitors brand health over time and predicts future performance. Receive prescriptive recommendations on how to grow your brand across audiences, and an early warning system to course-correct to maintain strong growth.

Connect brand investments to financial results.

Finally understand and report on the financial impact brand investments have on short- and long-term business value. Manage and mitigate risks by assessing and forecasting predictive scenarios to understand which strategies will drive the most significant lift in revenue and enterprise value.

Connect brand investments to financial results.

Summer '23

Be the first to see the latest capabilities we are adding to Brand Explorer and how these equip brand teams with the answers and insights they can’t get anywhere else.

- Automate the “why” behind shifts in your brand equity so you know what efforts and tactics to prioritize to generate the greatest ROI.

- Master your brand positioning with syndicated functional and experiential metrics that can influence purchase decisions, drive loyalty and enable your brand to excel in the market.

- Discover real-tie funnel metrics that help reduce friction and accelerate funnel conversion.

Integrate brand into all your marketing workflows

Solve your most common brand management challenges by tapping into better insights and context from more than 4,000+ global brands so your teams can accomplish all your brand initiatives with confidence.

Build a winning positioning strategy focusing on the right drivers to grow mindshare, consideration, and loyalty.

Brand valuation

Gain visibility into the metrics driving brand growth and track contribution to revenue and value over time.

Partner evaluation

Prioritize and de-risk partnership decisions by knowing which relationships close gaps, reinforce strengths, and deliver the best return.

Test and measure how effectively advertising delivers the proper engagements to influence minds and drive consumers towards your brand.

Understand the relationship different audiences have with your brand, pricing elasticity, and probability of winning brand consideration and loyalty with different target segments.

Identify core factors of your brand’s DNA, know what to prioritize, and how to increase revenue and value over time.

Discover which metrics will drive the greatest growth potential and adjust allocation to achieve short- and long-term growth goals.

Calibrate brand to financial objectives and spend by decomposing tactical efforts to understand which components move the needle.

Get intuitive software plus all the support you want.

BERA’s in-house experts help brands better understand and use data, reports, and analysis to determine where they are today, where they need to go tomorrow, and how to best execute a strategy for success.